How can Banks achieve better customer service and reduced operational risk? By linking incoming emails to customer data using Verisend Inbox+.

|

Verisend Inbox+ provides the following benefits for community banks:

- Improve Customer Service. With the ability to view customer information in the Inbox, banks are better able to provide a more comprehensive view of the customer relationship, allowing for better relationship management and faster resolution of customer issues.

- Reduce Operational Risk of falling victim to a clever phishing attack, posing as a bank customer, to request fraudulent money transfers.

- Increase Customer Loyalty: By providing personalized information and offers to customers, community banks can create a more positive customer experience, which can lead to increased customer loyalty.

Overall, the integration of your KYC information with your email client helps to improve customer service, improves compliance and productivity while reducing operational risk

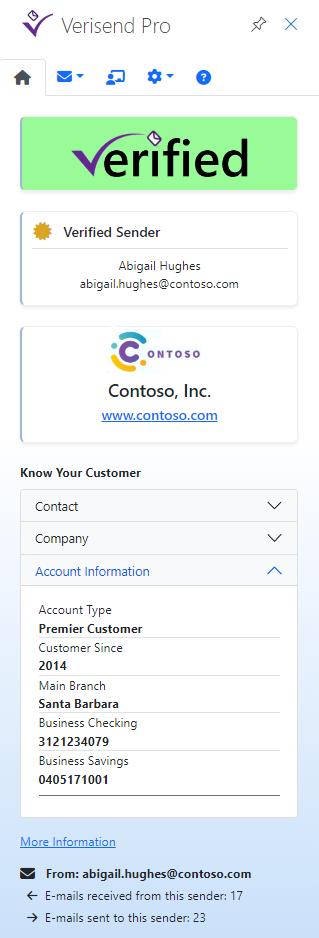

The Sample User Display panel for O365 shows key KYC information.

|

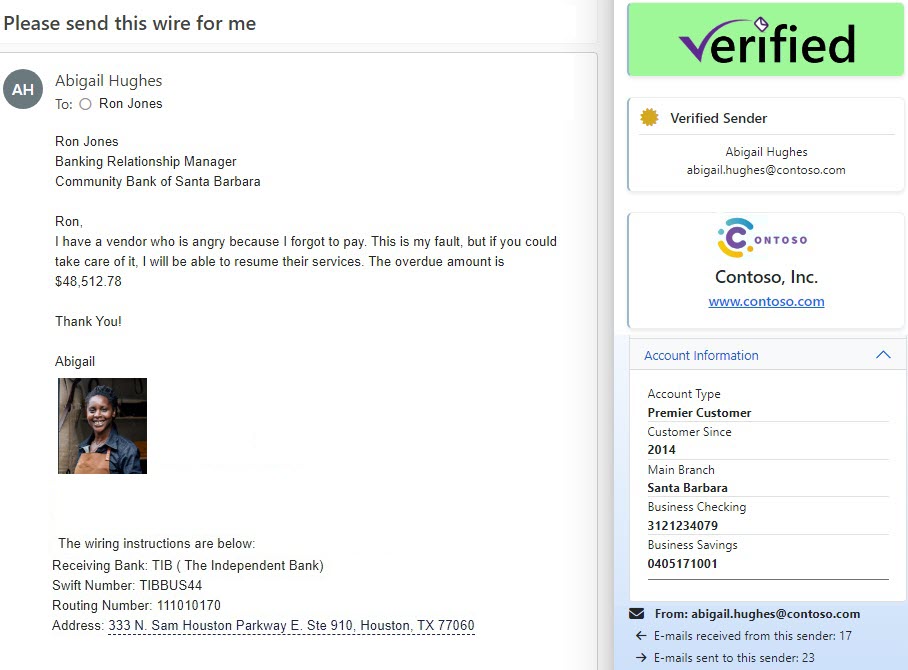

Message from a Verified Bank Customer |

With Verisend implemented at a Bank, the user has access to a full customer display panel which clearly and unanbiguously identifies the message as follows:

1. Customer: The email is certified as Verified with the green box and check mark, making it 100% clear that this message originated from a Bank Customer

2. Emails sent and received: Bank customers actual mail count. This is generally greater than 1.

3. KYC Customer information, right in the Inbox. This brings more information to the Bank employee, improving productivity and allowing them to provide faster and better customer service.

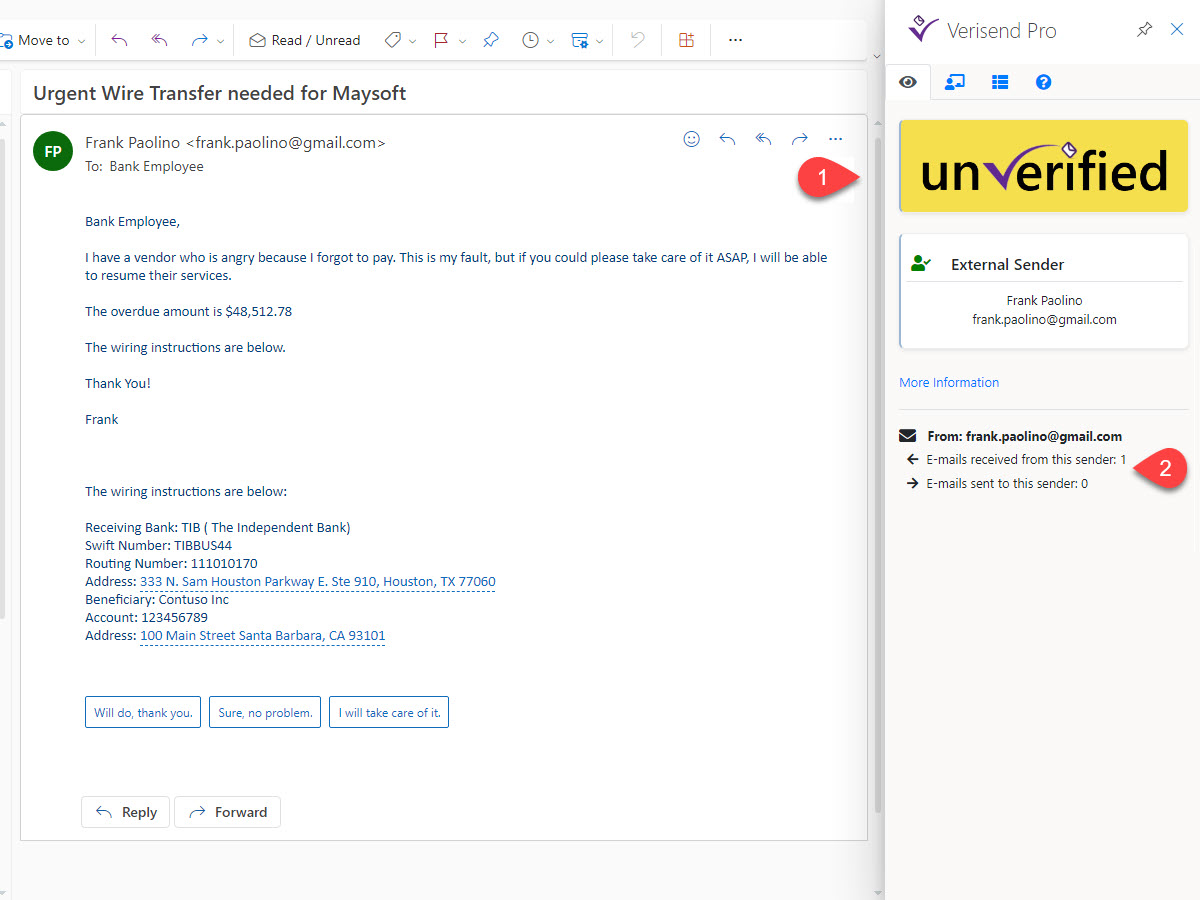

| Fraudulent Message Pretending to be from a Bank Customer |

Notice that the message does not display any customer information because this is a phishing attempt, and the fake email address is not in the KYC database.

1. UnVerified: The yellow unVerified image tells the Bank employee to use caution.

2. Emails sent and received: When this is 1 that means this is the only communication with this person, so this is most likely a fake email address setup only for the purpose of defrauding the Bank.

Want to try Verisend in your MS365 Tenant? |

Click here to book a 30-minute meeting to find out more about how Verisend Inbox+ can help your organization.

30 Minute Meeting

or Call: Allison Cote at (978) 635-1335

or Email: Allison@maysoft.com